You need to know where your business is headed. To make that happen, you have to frequently make informed projections about sales, production, and costs. Pro forma financial statements are a great way to assess the financial impact of those assumptions.

Here we’ll be covering definitions, uses, and benefits of pro forma statements. To go to a particular section, use the jump-to menu below.

Pro forma is a Latin term that roughly translates to “as a matter of form,” and is most often used to describe a document that is based on financial assumptions or projections, such as a pro forma balance sheet.

and cash flow statement." width="" />

and cash flow statement." width="" />

Pro forma financial statements are used in a business plan to present the best-case, expected, and worst-case scenarios for a proposed transaction. With pro forma statements, businesses can better make assumptions on what decisions are best for the company, such as labor increases, production increases, or even expansion.

You can also use pro forma statements to generate financial ratios. If, for example, you want to calculate the impact on the debt-to-equity ratio in future years, you can use the data from pro forma reports.

For business owners, the term pro forma means “what if?” Owners create a set of projected financial statements , including the balance sheet, income statement, and cash flow statement, based on a set of assumptions.

Every small business should create a budget , and the budgeted financial results are pro forma statements. The budget makes assumptions about sales, production, and pricing. An owner may create pro forma reports to assess the potential profitability of a product, or to determine if a business expansion makes financial sense.

Pro forma financial statements or projections can be used in a variety of scenarios:

Keep in mind that the American Institute of Certified Public Accountants ( AICPA ), and the Securities and Exchange Commission ( SEC) both have guidelines for creating pro forma statements.

Please note: Pro forma financial reports do not comply with generally accepted accounting principles (GAAP). You must distinguish between pro forma and actual financial statements: The Financial Accounting Standards Board (FASB), the governing body that establishes GAAP, requires that pro forma reports must be clearly labeled as such.

Like all things, not every aspect of pro forma is perfect. There are both benefits and downsides to the assumption structure that pro forma is built upon.

Pro forma financial statements help owners identify growth opportunities and limit risk. Assume, for example, that a retailer creates a pro forma income statement for the upcoming year. The income statement includes these categories:

Each of the line items can be changed to create different scenarios. For example, sales might be presented as 15% higher (best case), 5% higher (expected), 20% lower (worst case). If material costs increase sharply, or there is a shortage of labor, the cost of sales will increase.

An owner can create pro forma financial statements and consider these questions:

Pro forma financial statements are a great tool to evaluate alternatives. Most businesses have limited resources, and pro forma reports can help you make better decisions with what you have.

Unfortunately, there are also disadvantages that accompany pro forma financial statements.

The limitation of these statements is that they show the business owner nothing more than a prediction. No matter how good or bad that portrayal may seem, it’s only a good guess as to what may happen.

These assumptions can be off by a little or a lot, but the bottom line is their outcomes should not be weighed too heavily in decision-making without other indicators to back up the assumption. And as we mentioned earlier, they are not in compliance with GAAP, which means they have to be labeled as pro forma and cannot replace formal financial statements.

It’s common to use different types of pro forma financial statements for different scenarios. The baseline is still the income statement, balance sheet, and statement of cash flows, however, each type has a different purpose associated with it.

An investment projection would showcase what an influx of cash could potentially do to your business. For example, if you were contemplating taking on an investor, it would give you a risk vs. reward scenario.

These types of projections are best for:

A full-year projection is just what the name suggests—accounting for the current year. For example, if it’s currently April and you want to perform a full-year pro forma projection, you would account for all the financials up to April and project the remainder of the year.

These types of projections are best for:

A risk analysis projection entails analyzing future possible risks and scenarios that the company may face. For example, what if your landlord raises your location’s rent? How will you be able to handle it?

These types of projections are best for:

Within business, it’s common for one company to acquire the other. Another possibility is a merger, where one business joins another. In either case, an acquisition projection needs to be run. This is when you take the financial statements of your business and merge them with financial statements of the other to see what your previous year might’ve looked like and what it may look like in the future.

These types of projections are best for:

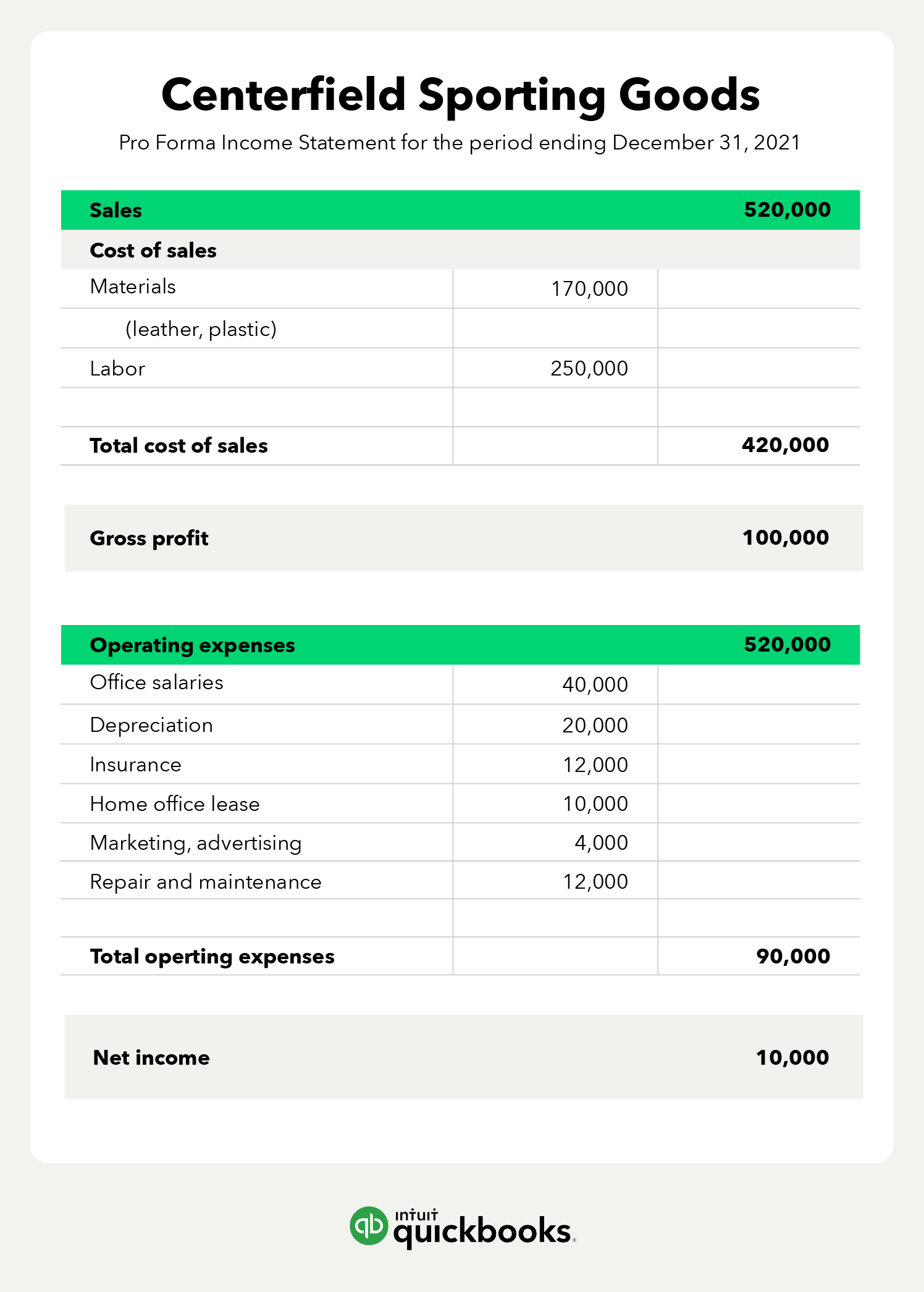

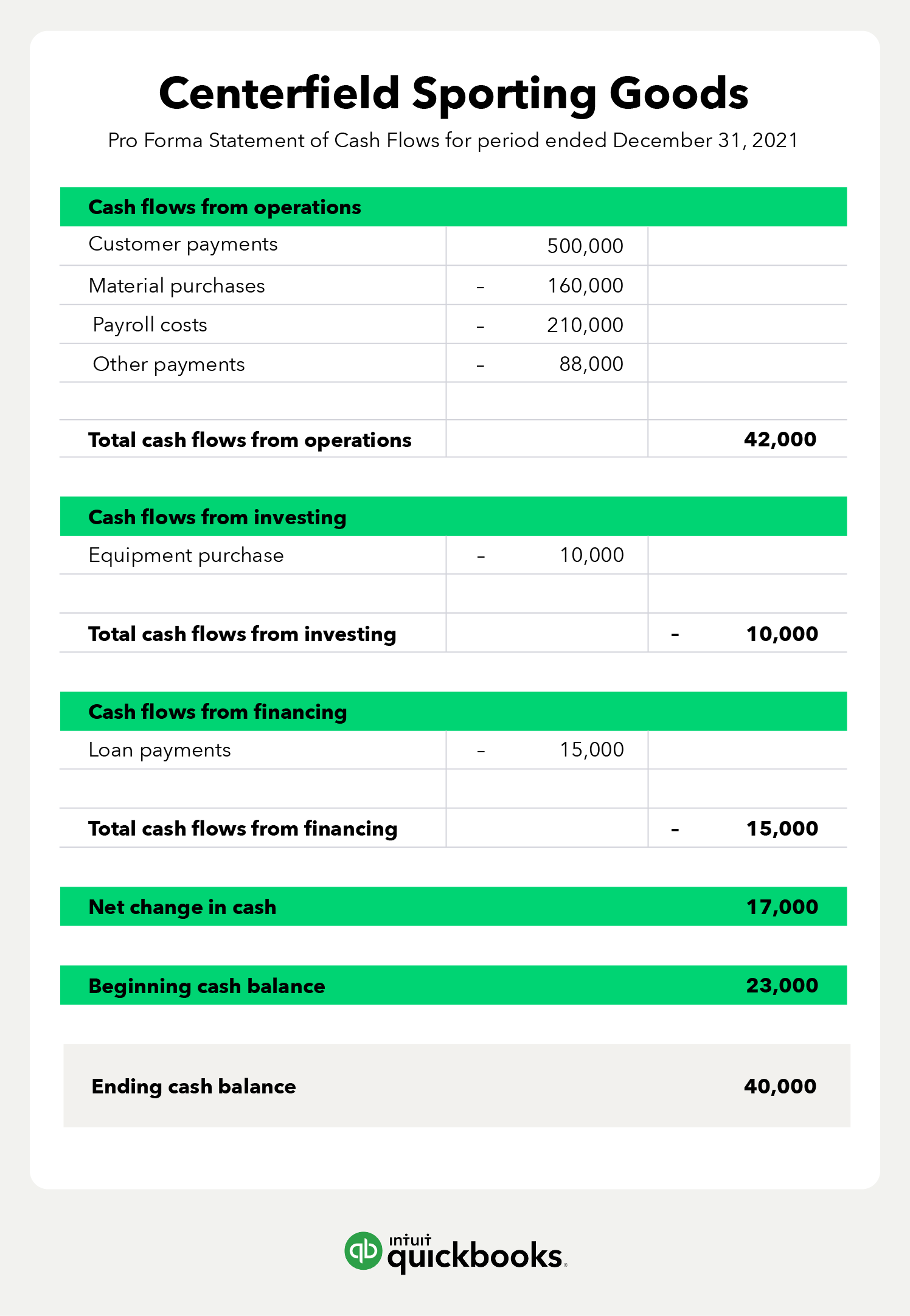

To illustrate the process of creating pro forma financial statements, meet Sally, the owner of Centerfield Sporting Goods. Centerfield is a small firm that manufactures baseball gloves, and Sally is creating pro forma reports for the 2021 fiscal year.

The process starts with the income statement.

Sally estimates the number of gloves sold in 2021 and uses that total to calculate sales, which is the first line item in the income statement below:

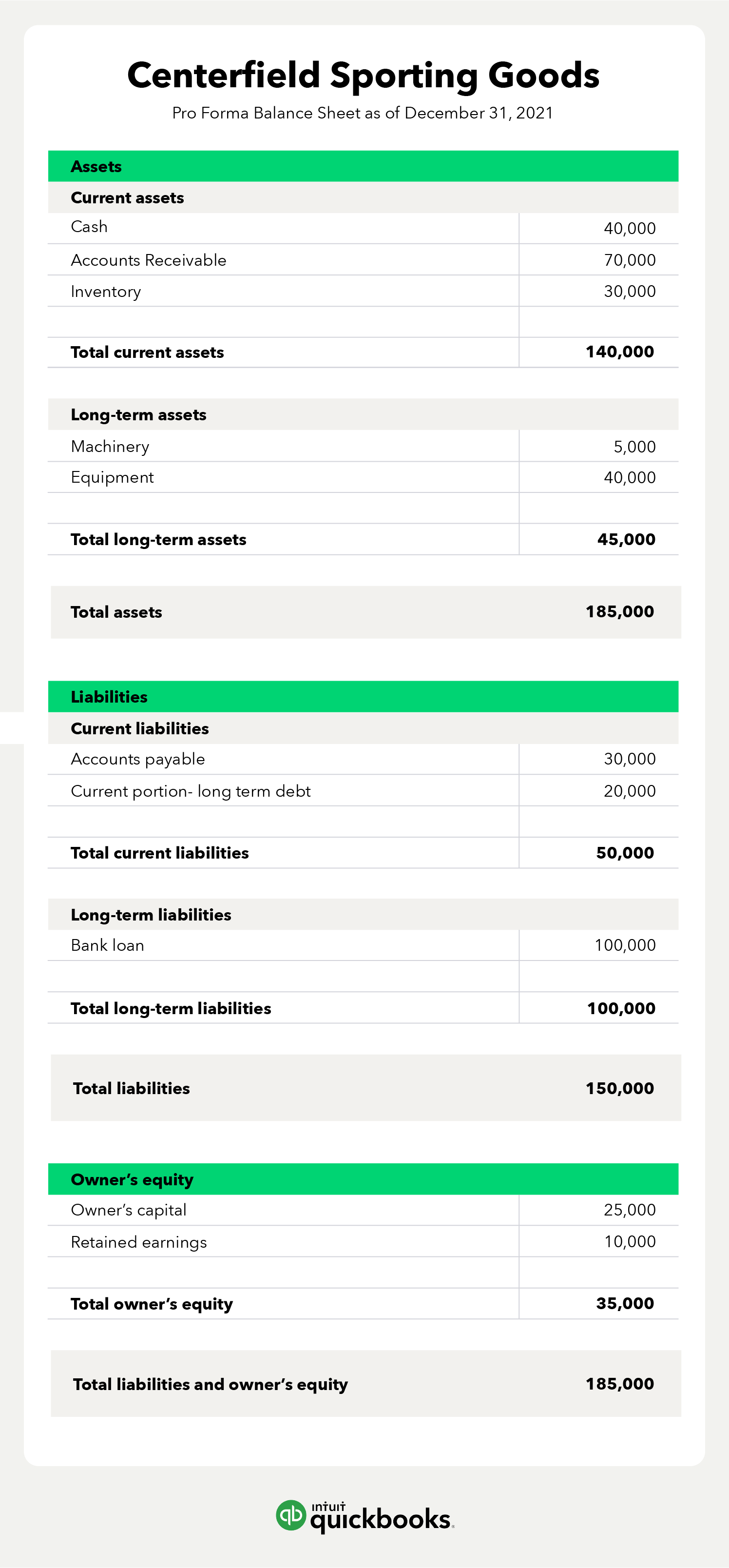

Sally uses her sales estimate to estimate the dollar amount of inventory at the end of 2021. The sales total and customer payment history help the firm determine the accounts receivable balance. Both balances are listed below.

Now the income statement, balance sheet, and other data can be used to create the statement of cash flows.

Cash flow from operations includes cash inflows from customer payments, and cash outflow for material purchases and payroll costs.

Pro forma financial statements are a great tool for financial management , to assess your financial position in the current year, and for any future time period. If you’re considering a major decision, such as a business merger or a new product launch, creating pro forma statements is important.

QuickBooks accounting software allows you to create pro forma statements and make changes as needed. You can make pro forma adjustments based on new information and use these statements to find opportunities, reduce risk, and increase profits.

Recommended for you

What does financial management mean for business owners?

February 1, 2021

Financial statements: What business owners should know

January 19, 2024

How to fill out a 1099 form: Step-by-step instructions and tips

October 13, 2023

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.